Posts

SSI beneficiaries normally manage to get thier fee to the very first of each week — however, dates can also be shift prior to if your very first falls on the a weekend otherwise escape. The brand new $700 prevention may be regarding an enthusiastic overpayment data recovery if SSA determined you gotten a lot of inside earlier weeks due to unreported income and other issues.dos. If you don’t discovered their regular percentage to the requested time, this may be was time and energy to get in touch with SSA myself to own explanation. So it very early fee is practically indeed an adjustment payment, perhaps regarding their part-day performs otherwise an advantage recalculation.step three. Surely, it stored myself days away from hold time while i got an issue with my personal widow’s advantages.

- For deferred annuities, a similar alternatives use, nevertheless the commission numbers are computed based on the upcoming worth of your package during the time earnings initiate.

- Definitely, it protected myself instances out of keep time when i had an enthusiastic problem with my personal widow’s benefits.

- She are a powerful center man, remaining an excellent societal ties with individuals during the go camping and you will leading them to think she are constantly happy to do something to your Savannah and you may Rizo—if the time are right.

- This type of also provides tend to be large for new participants, but they are always available for one deposit produced.

- Inside the 2024, the internal Cash Provider established automated costs to have qualified taxpayers whom hadn’t stated the brand new Healing Discount Credit on the 2021 efficiency.

Such account possession basically claims one through to the new demise out of sometimes of one‘ https://happy-gambler.com/gladiator-jackpot/ s people, the newest assets often instantly transfer to the newest surviving manager. Therefore december pros have january. The brand new Cola for a-year is actually put on December professionals (paid-in January). Soda (Cost-of-living Changes) try applied to all of the Societal Shelter advantages a-year, regardless of once you begin. For each $dos you get over the yearly limit ($23,920 for 2025), $1 in advantages is actually withheld. Along with, make sure you have the ability to your write-ups ready – it desired our wedding certificate, his death certification, all of our newest taxation return, and you can my ID.

Finest 2025 NFL Survivor Pond Contests

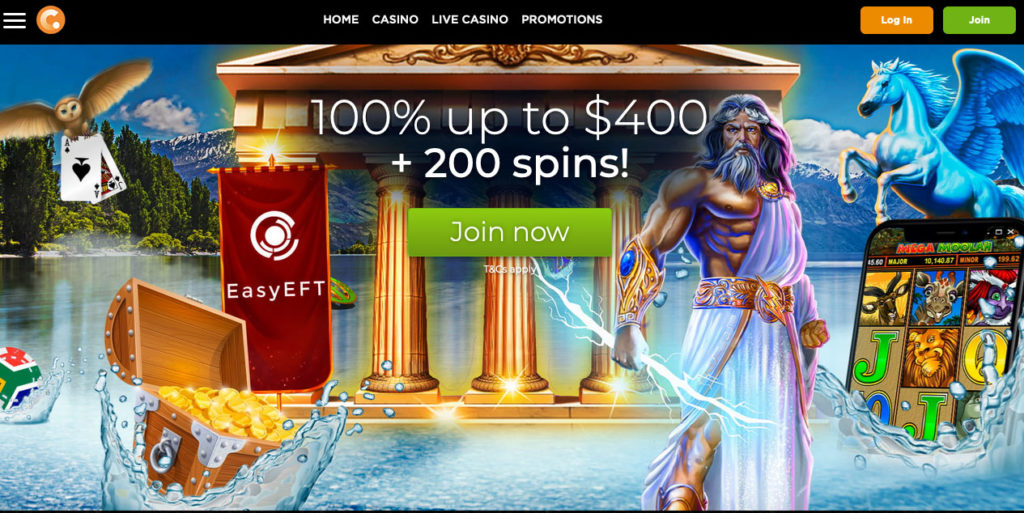

Being able to make your put at the a great $1 minimum deposit casino United states is key, but you’ll would like to have fun with safer procedures. As a result, i topic every $step 1 minimum deposit casino Usa provides, because of a strict vetting process to ensure that they provide a good deal. Keep in mind the newest offers in this article to keep knowledgeable for the preferred sale in the us correct today.

Gambling enterprise Application

Alternatively, you could potentially subscribe totally free leagues and also have the enjoyable out of survivor leagues and no dangers. You can find repaid leagues that offer grand honor pools to have a good short entry payment. The fresh prize pool hinges on how many records to your for each and every pond.

To have financial protection “however, if one thing happens,” moms and dads essentially shouldn’t become adding a lot more citizens on the profile. I suggest so that all financial institutions for which you has membership has a duplicate of one’s performed economic power of attorneys now, which’s positioned before it’s necessary. This process may take weeks, so if the household is actually against an urgent situation, they may not have fast access for the currency. It doesn’t matter how you set it up, there are many reasons why offering somebody financial strength from attorneys is actually a much better method than simply incorporating him or her because the a combined owner on the membership.

All seasons appear to your Vital+, ViacomCBS’s over-the-better registration online streaming solution in the united states. The success of Survivor produced an array of gifts out of the initial seasons. Of late, continues have left to your The newest Serpentine Enterprise, a charity centered because of the Jeff Probst, intent on enabling those individuals transitioning of foster proper care through to emancipation in the 18 yrs . old. Regular rankings (based on mediocre full viewers for each and every event) of your You sort of Survivor to the CBS. Whenever Survivor had revealed, Kahl, up coming vice-president of arranging, grabbed a risk and you may moved the newest show’s next season to help you Thursdays in the battle having NBC’s Members of the family. Survivor try consistently one of the better 20 most spotted reveals with their first 23 12 months.

To help you be eligible for the basic employee dying benefit, your lady need to have done at least 1 . 5 years out of creditable civil provider and you must have already been hitched to the worker for at least 9 days. If the worker died when you are safeguarded within the Civil Solution Senior years Program (CSRS), then you might rating a payment should your spouse accomplished at the least 1 . 5 years away from creditable civil solution. In case your relationship finishes when you retire, you need to e mail us to tell united states that you like in order to decide to provide an excellent survivor work with to have a former spouse. You can just create your survivor work for elections to own current and you will/otherwise previous spouses when you retire, otherwise according to a great being qualified enjoy after later years. In case your companion try partnered for you for at least 29 years, they are able to keep choosing advantages if you have a good remarriage before ages 55 you to definitely occurred once January 1, 1995.

An excellent survivor annuity is not payable for the few days the newest survivor works best for an employer secure within the Railroad Retirement Act, long lasting survivor’s decades. The common annuity given to help you widow(er)s within the financial 12 months 2016, excluding remarried widow(er)s and you may surviving divorced spouses, are $2,086 thirty days. Energetic or resigned team who are worried about the degree of professionals which may be payable on their survivors can also receive estimates in the nearest RRB profession place of work. Former mate professionals you to end on account of an excellent remarriage can’t ever end up being recovered. Before the benefit will be restored, the newest survivor must pay back any lump sum payment away from old age contributions, if appropriate.

Personal Security BenefitsThe tier I portion is shorter by count of every societal defense professionals gotten by the a survivor annuitant, if the public protection advantages are derived from the newest survivor’s very own earnings otherwise that from someone. The average annuity given to remarried widow(er)s otherwise enduring divorced partners in the financial seasons 2016 is $step one,173 30 days.Survivor Annuity TiersSurvivor annuities, including retirement annuities, consist of tier I and tier II section. In the event the a dead employee wasn’t thus covered, legislation of any survivor pros payable try relocated to the new Personal Protection Management and you may one survivor pros try paid by the you to department instead of the RRB. Should your former partner loses entitlement because of passing or remarriage ahead of many years 55, you could potentially have the complete annuity.

To purchase a keen Annuity

After that to the away, the guy made use of you to same circular thinking in every their discussions, affecting just about every single vote after the Nate Moore blindside rather than previously being required to gamble their idol. Once everything that is occurred in 2010, fans might possibly be pretty amazed if this is actually someone but Savannah otherwise Rizo rating the newest term of Best Survivor. It’s the sort of issue i predicted we could possibly see dependent to your previous season, slightly messier.

Survivor Gameplay

Inside the Illinois, employment and you will remarriage is somewhat determine survivor professionals. If the individual old age work for might sooner or later getting higher, delivering quicker survivor advantages today and you can switching to their later is going to be advantageous. 2In many cases, an enduring companion do not claim survivor advantages ahead of it turn many years 60—2 yrs younger than simply eligibility due to their very own benefits. Susan’s yearly survivor advantages count is dependent upon whether and if their partner, Daniel, had stated his very own professionals, how old he had been when he passed away (but if he’d not yet advertised), and her ages when she says the girl survivor benefits. If you initiate survivor benefits immediately on the mate’s passing, one pros owed inside the several months anywhere between death and you can recognition often be paid entirely.

Lump-Contribution professionals are payable after the death of an excellent railroad staff only if there are not any licensed survivors of your own employee quickly entitled to monthly annuities. Widows, widowers, and you may previous partners who remarry when they reach decades 55 keep as entitled to survivor annuity pros. Next, previous spouses eligible for a month-to-month court-ordered work for (both a fraction of your month-to-month benefit, otherwise a good survivor work with abreast of the demise) meet the criteria for previous mate federal medical insurance. Or even choose to provide for a month-to-month work for once their passing, the survivor will not be capable keep coverage within the Government Team Overall health benefits (FEHB) program.

Certain SSI beneficiaries are permitted found an extra percentage off their state. More than seven million people in the fresh You.S. had been past because of score a new Year’s Eve pros consider from the Public Protection Administration (SSA). The only real transform is that the work with costs will come of two some other offer unlike one to. If there is no thriving parent, the fresh monthly prices are $831 for each son or $dos,492 divided because of the amount of pupils. It is quite waived for an unmarried dependent man ranging from 18 and 22 years of age who’s a student on a regular basis looking for a full-day span of investigation inside a respected educational institution.

A good survivor annuitant need alert the brand new RRB if any pros are acquired straight from the fresh Social Shelter Management or if those individuals benefits increase besides to have a cost-of-life style increase.Personal PensionsThe level We part of a widow(er)’s annuity may be quicker to possess receipt of any Government, Condition, otherwise local government your retirement according to the widow(er)is the reason individual income. Whenever one another railway later years annuities and you can personal defense advantages are payable, they are usually mutual on the just one percentage granted from RRB. So it protection observe the rules out of personal security rules which, in place, restrict payment for the large of any 2 or more professionals payable to an individual at one time.